Meta Ads Payments: Credit Cards, Invoicing, and a Crash Course in Transaction Types

Meta Ads payments explained: from small credit card holds to monthly invoicing, learn how Meta's process really works and what to expect as a new advertiser.

When I launched an Instagram ad campaign, I expected creativity and strategy to be my main focus—not figuring out the ins and outs of how Meta Ads processes payments.

Instead, I found myself learning a lot more about how credit card transactions work, the quirks of Meta's payment system, and even how different kinds of holds or authorisations show up on my account.

Here’s what I learned and how it might help you if you're running ads or just want to understand credit card transactions better.

The Start: Choosing a Payment Method for Meta Ads

When starting my campaign, I opted to pay via credit card. Meta, now operating Instagram and Facebook advertising, offers several payment methods, including credit cards, bank transfers, and direct debits. I chose credit card for the flexibility, assuming it would be as simple as making a regular online purchase.

Little did I know that Meta’s system isn’t quite that straightforward. While it is efficient and trustworthy, the way they handle authorisations, reservations, and final payments involves multiple steps that can be confusing at first.

Micro-Reservations: The Surprise of Small Holds

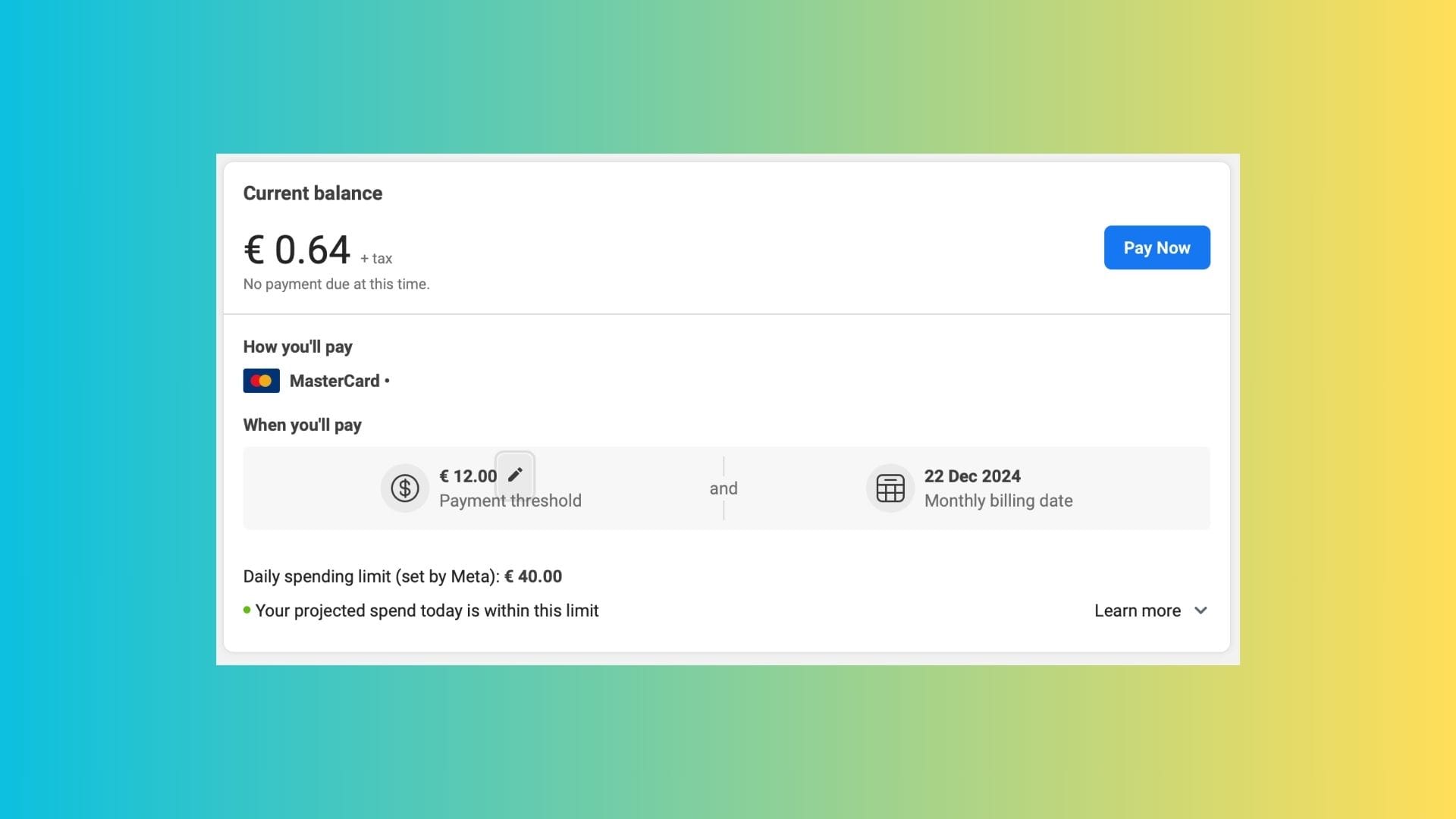

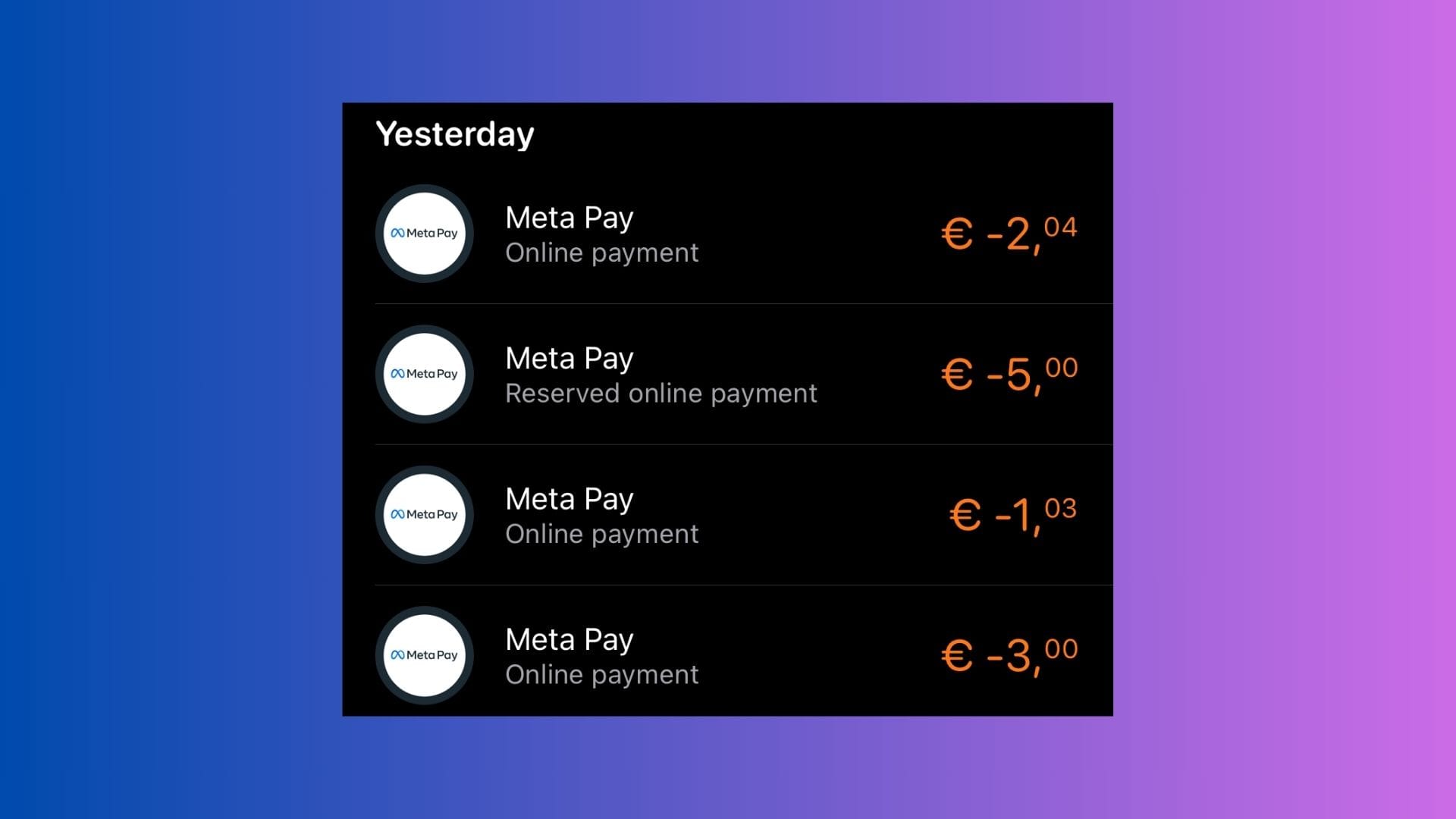

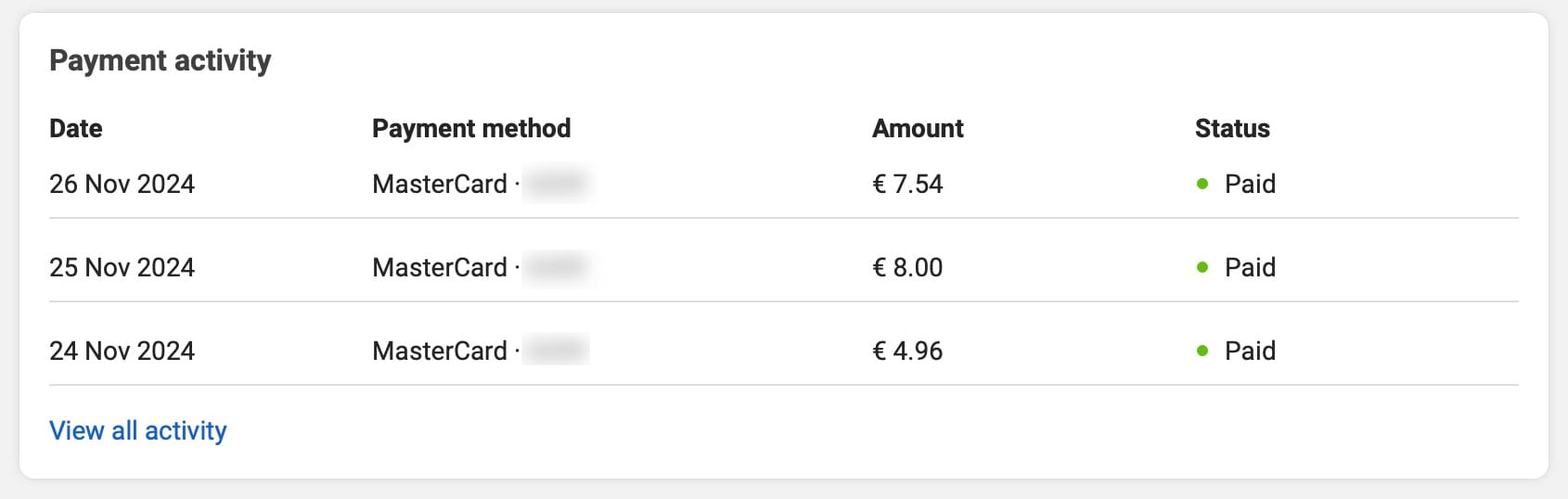

Once my ad campaign was live, I quickly noticed small, recurring €2 reservations on my credit card. Even though I had set a payment threshold of €100, Meta didn’t immediately take that amount. Instead, they started by placing small holds—€2 here, €5 there—as if testing the waters before incrementing. Meta actually captured these small amounts, meaning the funds were formally taken from my account. After capturing, it took a while before my bank updated the status of these transactions from reserved to paid.

Each of these authorisations came with an email notification, giving me the sense of being constantly bombarded by payment updates, even though no actual money was leaving my account. It turns out that this process is Meta’s way of ensuring everything works smoothly before they allow you to build up larger balances. But as a new advertiser, it did feel a bit chaotic at first.

Authorisations vs Reservations: What Are They?

This experience with Meta taught me a lot about the difference between authorisations and reservations. An authorisation is the first step: it’s essentially Meta checking whether the money is available. It doesn’t move the funds yet, but it places a hold on them—reducing my available credit.

A reservation, in this context, is what happens after the authorisation. It ensures that the money is still set aside for Meta and cannot be spent elsewhere, but it hasn’t formally left my account. This meant I had less money available, even though the amount wasn't officially deducted. And unlike a typical online purchase, there was no immediate transfer to Meta.

Capturing the Payment: When Does the Money Leave?

Eventually, after accumulating spending to meet my €100 threshold, Meta captured the payment. This is when the reserved amount formally leaves your account, becoming an actual payment. However, this didn’t appear in my bank account immediately. There was a delay—sometimes a day or more—between Meta processing the payment and it showing up on my credit card statement. This lag can make it feel like you’re unsure whether the payment has been processed or not.

Understanding this process made it clear why hotels often tell guests, “It’s just an authorisation, no payment necessary.” The same concept applies here—the money isn’t gone, just held until the transaction completes or is released.

Invoicing with Meta: The Monthly Recap

Meta’s payment system starts with a low threshold, resulting in frequent small charges. Each payment generates an invoice, an email notification, and a status update in Meta marking it as 'paid'. As you continue to advertise, the threshold gradually increases. This means you’ll see fewer individual payments and invoices over time.

Eventually, if the threshold surpasses your total monthly ad spend, Meta consolidates the charges and bills you only once per month. This single monthly invoice summarises all ad expenses during the billing cycle, providing a more streamlined record for tax reporting and bookkeeping.

While the system transitions from frequent payments to a consolidated monthly charge, it’s essential to track individual transactions early on. The initial phase, with its numerous small payments, offers detailed visibility into your spending. Later, the consolidated invoices make bookkeeping simpler, provided you’ve kept a record of earlier transactions.

This approach works well once you understand how the system evolves, but initially, the frequent charges and low thresholds can be a bit confusing. Over time, however, the system becomes more efficient, especially for advertisers with consistent or lower ad spend.

Key Takeaways for Advertisers

- Meta Ads Start Small: Meta’s initial use of small authorisations is a way to build trust and ensure funds are available, but it can feel overwhelming with all the notifications.

- Understand Authorisations and Reservations: These are not final payments, but they do reduce your available balance, which can be confusing if you’re not expecting it.

- Payment Capture Lags: Even after Meta decides to capture the funds, it can take time to appear on your bank statement. Don’t panic if there’s a delay.

- Monthly Invoices Simplify, but Track Closely: The monthly invoice is convenient, but it means you need to be organised throughout the month to match payments accurately.

Final Thoughts

Using a credit card for Meta Ads taught me a lot more about payment systems than I expected. Their approach, which includes frequent small authorisations, delayed captures, and monthly consolidated invoicing, is efficient but not intuitive at first. Understanding how different transaction types—like authorisations, reservations, and deposits—work can help you better manage your finances, especially if you’re running campaigns or dealing with high-value transactions.

If you’ve had similar experiences or felt confused by Meta’s payment process, I hope this overview helps you navigate it more confidently. Feel free to share your thoughts or questions—I’d love to hear about your experiences too!

The other thing I noted is that even when the bank says it is a reservation, the amount will appear in the bookkeeping software.